0

0

0

To amend the Internal Revenue Code of 1986 to provide that certain payments to foreign related parties subject to sufficient foreign tax are not treated as base erosion payments.

3/24/2025, 1:18 PM

Summary of Bill HR 1911

Bill 119 HR 1911, also known as the "Foreign Tax Credit Protection Act," aims to amend the Internal Revenue Code of 1986 in order to clarify that certain payments made to foreign related parties, which are subject to sufficient foreign tax, should not be considered as base erosion payments.

The bill seeks to address concerns regarding the treatment of payments made to foreign related parties for tax purposes. Specifically, it aims to ensure that payments made to foreign related parties that are subject to an adequate amount of foreign tax are not unfairly penalized or categorized as base erosion payments.

By making this amendment to the Internal Revenue Code, the bill aims to provide clarity and certainty for taxpayers engaging in transactions with foreign related parties. This clarification is intended to prevent unintended consequences and ensure that taxpayers are not unfairly penalized for engaging in legitimate business transactions. Overall, the Foreign Tax Credit Protection Act seeks to promote fairness and transparency in the tax treatment of payments made to foreign related parties, while also providing certainty for taxpayers and reducing the risk of base erosion.

The bill seeks to address concerns regarding the treatment of payments made to foreign related parties for tax purposes. Specifically, it aims to ensure that payments made to foreign related parties that are subject to an adequate amount of foreign tax are not unfairly penalized or categorized as base erosion payments.

By making this amendment to the Internal Revenue Code, the bill aims to provide clarity and certainty for taxpayers engaging in transactions with foreign related parties. This clarification is intended to prevent unintended consequences and ensure that taxpayers are not unfairly penalized for engaging in legitimate business transactions. Overall, the Foreign Tax Credit Protection Act seeks to promote fairness and transparency in the tax treatment of payments made to foreign related parties, while also providing certainty for taxpayers and reducing the risk of base erosion.

Read the Full Bill

Current Status of Bill HR 1911

Bill HR 1911 is currently in the status of Bill Introduced since March 6, 2025. Bill HR 1911 was introduced during Congress 119 and was introduced to the House on March 6, 2025. Bill HR 1911's most recent activity was Referred to the House Committee on Ways and Means. as of March 6, 2025

Bipartisan Support of Bill HR 1911

Total Number of Sponsors

2Democrat Sponsors

2Republican Sponsors

0Unaffiliated Sponsors

0Total Number of Cosponsors

2Democrat Cosponsors

1Republican Cosponsors

1Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill HR 1911

Primary Policy Focus

Alternate Title(s) of Bill HR 1911

To amend the Internal Revenue Code of 1986 to provide that certain payments to foreign related parties subject to sufficient foreign tax are not treated as base erosion payments.

To amend the Internal Revenue Code of 1986 to provide that certain payments to foreign related parties subject to sufficient foreign tax are not treated as base erosion payments.

Comments

Ayla Boykin

30,036

10 months ago

This bill sucks, it's gonna mess with my money and I ain't happy about it.

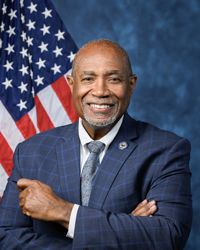

Sponsors and Cosponsors of HR 1911

Latest Bills

Providing for consideration of the bill (S. 1383) to establish the Veterans Advisory Committee on Equal Access, and for other purposes; providing for consideration of the bill (H.R. 2189) to modernize Federal firearms laws to account for advancements in technology and less-than-lethal weapons, and for other purposes; providing for consideration of the bill (H.R. 261) to amend the National Marine Sanctuaries Act to prohibit requiring an authorization for the installation, continued presence, operation, maintenance, repair, or recovery of undersea fiber optic cables in a national marine sanctuary if such activities have previously been authorized by a Federal or State agency; providing for consideration of the bill (H.R. 3617) to amend the Department of Energy Organization Act to secure the supply of critical energy resources, including critical minerals and other materials, and for other purposes; and waiving a requirement of clause 6(a) of rule XIII with respect to consideration of certain resolutions reported from the Committee on Rules.

Bill HRES 1057February 12, 2026

Securing America’s Critical Minerals Supply Act

Bill HR 3617February 12, 2026

Veterans Accessibility Advisory Committee Act of 2025

Bill S 1383February 12, 2026

Law-Enforcement Innovate to De-Escalate Act

Bill HR 2189February 12, 2026

To amend the National Marine Sanctuaries Act to prohibit the Secretary of Commerce from prohibiting, or requiring any permit or other authorization for, the installation, continued presence, operation, maintenance, repair, or recovery of undersea fiber optic cables in a national marine sanctuary if such activities have been authorized by a Federal or State agency

Bill HR 261February 12, 2026

Defending American Property Abroad Act of 2026

Bill HR 7084February 12, 2026

A resolution condemning the Government of Iran for its suppression of the right of Iranians to peacefully assemble.

Bill SRES 606February 12, 2026

A resolution denouncing statements by President Donald J. Trump that he may "nationalize," commandeer, or otherwise assume direct control over elections.

Bill SRES 605February 12, 2026

A resolution recognizing that it is the duty of the Federal Government to develop and implement a Transgender Bill of Rights to protect and codify the rights of transgender and nonbinary people under the law and ensure their access to medical care, shelter, safety, and economic security.

Bill SRES 604February 12, 2026

A bill to amend the Internal Revenue Code of 1986 to modify the rules relating to inverted corporations.

Bill S 3847February 12, 2026